November 20, 2025

American Express® Gold Card Review

Pam

It’s time for a review of the card_name. You won’t be surprised to learn that I am a fan of American Express cards. I have personally found that American Express cards are usually easy to be approved for (but require excellent credit), which I am glad for because I love earning American Express Membership Rewards® transferable points. Plus, the cards have some amazing benefits. Here’s my review of the card_name, which is one of the cards I plan to always keep in my wallet.

Learn How to Apply

bonus_miles_full

I think for most households, at least one person should have this card in their wallet at all times. It just makes sense in so many everyday spending situations. Here are the main reasons it is a card worth keeping.

Earning Valuable Points

The most compelling benefit of my card_name is earning four points per dollar spent at U.S. supermarkets (on the first $25,000 of eligible purchases) and four points per dollar spent at restaurants worldwide (on the first $50,000 of eligible purchases). I typically spend about $600 every month at supermarkets and $200 at restaurants. That means I am spending $9,600 a year in those categories. Multiply that by four, and I earn 38,400 Membership Rewards® a year—more than enough for a round-trip domestic ticket on Delta (a transfer partner of American Express®).

I can also earn three points per dollar spent on eligible flights booked directly with an airline or through American Express Travel®, and one point per dollar spent on other eligible purchases.

With all the points I earn through regular spending on this card, I’ve already made this worth keeping! And we haven’t even gotten to all the great benefits yet.

Enrollment is required for select benefits.

$120 Dining Credit

The card_name gives you a $10 monthly dining credit (up to $120 annually) when you pay with your card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. I prefer using my credit at Grubhub because it is easy to redeem each month. Enrollment is required; terms apply.

Up to $120 in Uber Cash

The card gives you up to $120 in annual Uber Cash (in the form of $10 monthly credits) that can be used for U.S. Uber rides and for U.S. Uber Eats deliveries as well. I don’t use Uber often, but I enjoy eating out. I use my Uber Cash through the Uber Eats app on my phone and get $10 free each month. Simply download the Uber app, add your card_name information as payment, and each month, you will receive a $10 Uber credit for rides you take or deliveries you have made. Be sure to pay with that card when you order, and your $10 will be automatically subtracted.

$84 Dunkin’ Credit

If Dunkin’ coffee or donuts are your thing, you can get a $84 Dunkin’ credit annually ($7/month). Enrollment is required.

$100 Resy Credit

A $100 Resy credit ($50 semiannually) is redeemable at eligible U.S. restaurants that participate in the Resy program. Enrollment is also required for this benefit. I just used this credit for the first time and it works great—I had a great lunch with my sister at a local restaurant.

$100 Hotel Credit

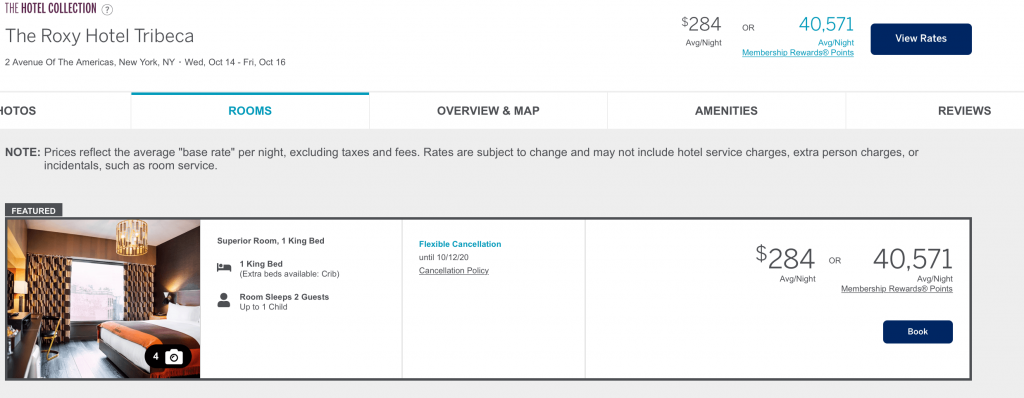

If you book a hotel through The Hotel Collection by American Express, pay with your card, and stay at least two consecutive nights, you will receive a $100 hotel credit. I have never taken advantage of this benefit, but I decided to check it out and randomly picked the Roxy Hotel.

If available, you get a room upgrade and a $100 credit to be applied to eligible hotel charges, such as spa treatments or dining.

Redeeming Your Points

The best value for redeeming your Membership Rewards® points is transferring them to Amex’s airline partners. They also have hotel partners, but using your points for flights is where you will usually get the most value. Airline partners include Aer Lingus, Aeromexico, Air Canada, Air France/KLM (Flying Blue), ANA, Avianca, British Airways, Cathay Pacific, Delta, Emirates, Etihad, Iberia, JetBlue, Qantas, Qatar, Singapore, and Virgin Atlantic. Hotel partners include Hilton, Choice, and Marriott Hotels. Not every transfer is a 1:1 transfer like with Chase Ultimate Rewards®, but many are.

Complete List of Benefits

- Earn 4 Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1 point per dollar spent for the rest of the year.

- Earn 4 Membership Rewards® points per dollar spent at U.S. supermarkets, on up to $25,000 in purchases per calendar year, then 1 point per dollar spent for the rest of the year.

- Earn 3 Membership Rewards® points per dollar spent on flights booked directly with airlines or with American Express Travel®.

- Earn 2 Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1 Membership Rewards® point per dollar spent on other eligible purchases.

- $120 Uber Cash: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4 Membership Rewards® points per dollar spent for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin’ Credit: With the $84 Dunkin’ Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin’ locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No foreign transaction fees.

- Terms Apply.

Bottom Line

I always use my $120 dining credit, Uber credit, and Dunkin’ credit, which means this card is always worth having. Being able to earn four points per dollar for food spending makes this a go-to card I use all the time. And now that I have started using the Resy credit, I’m benefitting even more from this card. (Another tip: when you go out with friends, always pay the bill at a restaurant with this card and let them Venmo you! More points!)

Is the American Express® Gold Card a keeper card in my wallet? Absolutely!

Opinions, reviews, analyses, and recommendations are the author’s alone and have not been reviewed, endorsed, or approved by any of these entities. Terms apply.

Related Posts

Changes to American Express Platinum Card®

How to Maximize Your Resy Credits

Podcast 155. End-of-Year Checklist: Credits, Perks & Expiring Rewards

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Points Talk Squad has partnered with CardRatings for our coverage of credit card products. Points Talk Squad and CardRatings may receive a commission from card issuers when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how or where products appear on this site. Points Talk Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.