December 29, 2025

Marriott Bonvoy® Status Match to Singapore KrisFlyer Status

Pam

I’ve long had Marriott Bonvoy® status with my credit cards and the status that comes with them. I also love flying Singapore Airlines, so I appreciated it when Traci (our compliance editor) sent me this link. Got Marriott status, like me? If so, you can status match to KrisFlyer, and it’s super easy!

Here’s the Marriott status you can receive simply by holding the right card:

- Marriott Bonvoy Brilliant® American Express® Card – Platinum Elite

- Marriott Bonvoy Bevy® American Express® Card – Gold Elite

- Marriott Bonvoy Bountiful™ Card – Gold Elite

- Marriott Bonvoy Business® American Express® Card – Gold Elite

- American Express Platinum Card® – Gold Elite

- The Business Platinum Card® from American Express – Gold Elite

Enrollment required. Terms apply.

Readers with Marriott Gold or higher elite status can match up to Silver status on Singapore Airlines, and then earn Gold status with just four Singapore flights within six months. If you are planning some trips to Asia, this is especially compelling.

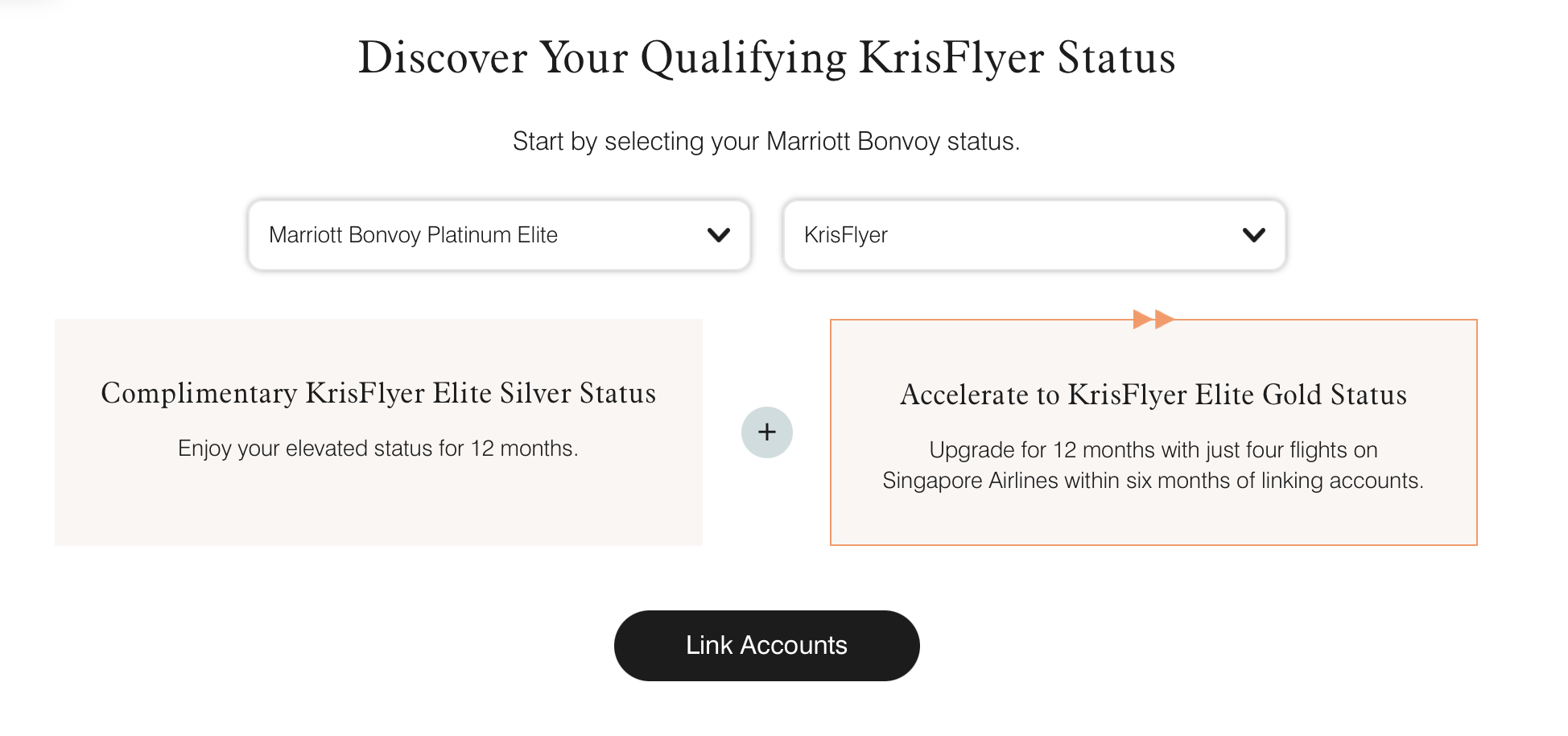

Here’s how to do it:

- Choose your status (you can see that I entered my Platinum Elite status for Marriott and my normal KrisFlyer status above).

- It told me what I could get for a matching KrisFlyer status = Elite Silver.

- I then linked both accounts by putting in the appropriate account offers.

- When done, I received this in my email.

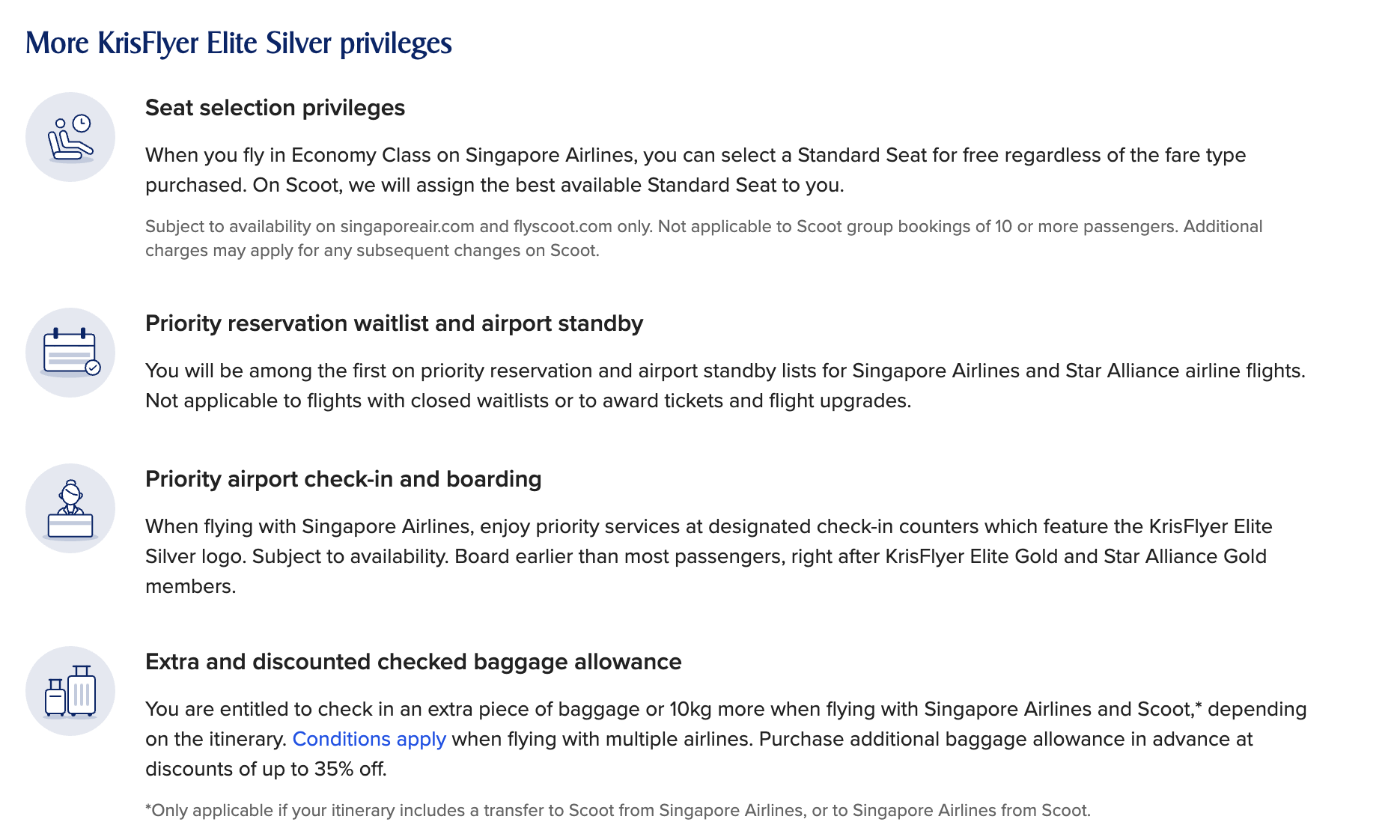

Here’s what KrisFlyer Elite Silver Status will give me:

Photo from Hyatt site.

Bottom Line

If you have Marriott elite status, be sure to status match to Singapore Airlines. I flew Singapore Airlines a couple of times last year. (It’s one of my favorites!) I need to book a flight with them this year and apply my Silver Elite status.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. American Express is a Travel Mom Squad advertiser, but we always show the best public offer even when we don’t earn a commission. Terms Apply.

Leave a Reply

Advertiser Disclosure: Points Talk Squad has partnered with CardRatings for our coverage of credit card products. Points Talk Squad and CardRatings may receive a commission from card issuers when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how or where products appear on this site. Points Talk Squad has not reviewed all available credit card offers on this site.

Editorial Note: Opinions expressed here are author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

be the first to comment

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.